Table of Contents

With so many types of guitar out there, the choices might leave you scratching your head! All sorts of guitars, each perfectly suited for certain music or playing styles.

Some are like Swiss army knives of music, good for striking a chord in any genre. Breaking it down, guitars typically fall into three categories: acoustic, electric, and bass.

Most guitarists recognize these, making them the go-to for beginners, given the abundance of learning tools and help on hand.

In this Killer Rig Article, we’re going to unpack the types of guitars, tossing in some important jargon along the way to help you choose wisely.

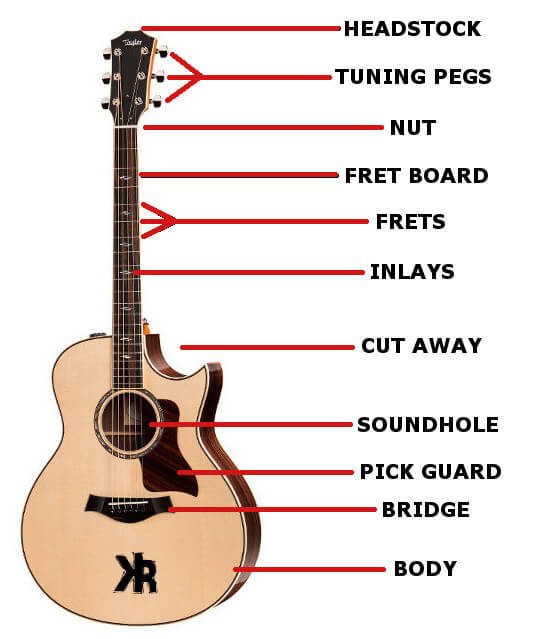

The Acoustic Guitar

You would probably imagine an acoustic if I asked you to visualize a guitar on the spot. It serves as the benchmark, immediate go-to, and all-purpose instrument.

It may be heard in all genres of music, from deep folk strums to catchy pop chords. And also from rustic country songs to moving blues ballads.

The acoustic guitar is a miracle of simplicity with its wood hollowbody and steel strings. With each strum, the body resonates and the strings vibrate, and suddenly the space is filled with music. It’s a classic design that is also incredibly practical.

Yet, the simplicity of the acoustic guitar is deceptive. Acoustic guitars come in a variety of shapes and sizes, each with a certain sound that sets it apart.

Take the dreadnought, for example. Its large body and robust sound make it a popular choice among bluegrass musicians.

And let’s not forget the choices of great tonewoods. Spruce, mahogany, ebony, each wood gives the guitar a specific sound. Spruce is loved for its bright, clear tone, while mahogany offers a warmer, darker sound.

The acoustic guitar is a testament to the beauty of simplicity. It’s proof that, sometimes, all you need to create soul-stirring music is six strings and a piece of wood.

The Classical Guitar

Classical, or nylon-string guitars, are deeply rooted in tradition.

They have long played a significant role in numerous cultures. Spain experienced a huge boom in classical guitar popularity at the beginning of the century. They are frequently used for genres like mariachi, flamenco, and classical music.

The use of nylon strings on classical guitars is one of its primary characteristics. These strings are responsible for the softer, warmer, and quieter sound that distinguishes them from steel-string acoustics.

The nylon strings also contribute to a more comfortable playing experience. Particularly for fingerstyle techniques and intricate flamenco patterns.

Classical guitars are designed with wider fretboards and flatter neck profiles. Making them more suitable for precise finger movements and complex chord shapes. This design further enhances their suitability for traditional and culturally-rich music styles.

Read my article: Acoustic Vs Classical Guitar.

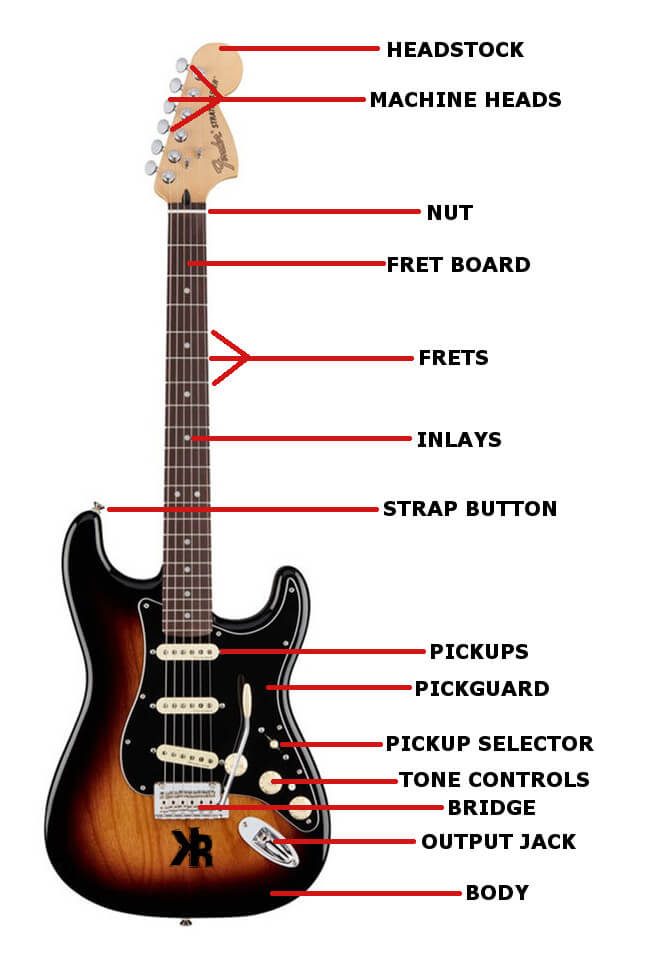

The Electric Guitar

Electric guitars employ magnetic pickups, which necessitate additional components. These pickups transform the string vibrations into electrical signals that are subsequently amplified by a guitar amplifier.

Electric guitars are celebrated for their versatility and ability to generate a diverse array of sounds and effects. This makes them a favorite among many guitarists.

Solid body electric guitars are the most prevalent type and feature a solid wood construction, which bolsters their sustain and tone. These guitars cater to a wide variety of musical genres, encompassing rock, metal, jazz, punk, and blues.

The sonic possibilities offered by solid-body electric guitars are virtually limitless! When paired with various effects and amplifiers with equalization options, the range of sounds achievable is astounding.

Iconic solid-body guitars such as the Fender Stratocaster and Gibson Les Paul have become synonymous with the instrument.

Inherently, solid-body guitars do not produce a significant volume on their own. Thus, an amplifier is typically necessary to attain the optimal sound and volume.

Unlike acoustic guitars, the solid wood body of electrics cannot project sound efficiently. However, the incorporation of pickups and electronics, including switches, provide solid body guitars with unparalleled versatility.

Plus, the ability to add effects like delay, chorus and wah-wah to your sound is an incredible way to enhance solos and riffs. They allow you to take a good song and make it great, all from a small pedalboard!

Extended Range

In addition to the standard 6-string models, electric guitars are available with 7, 8, and 9 strings. Offering an extended range of notes and catering to different guitar tunings.

These extended-range guitars are particularly popular among progressive rock, metal, and experimental musicians.

Players who seek unconventional and complex tunings. The vast range of options and configurations available for electric guitars further contributes to their popularity and versatility across various musical genres.

Hollow Bodies

Hollow Body guitars are favored by jazz and blues musicians due to their warm and rich sound. The bodies are just one large cavity like a thin acoustic with its own shape and features.

They also employ pickups, solidifying their place in the electric guitar category, and are also great for rock-n-roll.

However, one drawback is their susceptibility to feedback at high volume levels. Semi-hollow versions are also made to help with the feedback, but they also have a tone that is all their own.

The Bass Guitar

The bass guitar is a prominent instrument featured in numerous musical genres. Commonly found in 4-string models, bass guitars also come in various shapes and sizes to cater to different preferences.

Bass guitar strings are notably thicker and more widely spaced apart, enabling the instrument to produce lower frequencies. This characteristic is particularly important when playing alongside other instruments within an ensemble.

The scale length of a bass guitar typically ranges between 30 and 36 inches, resulting in highly tensioned strings.

Consequently, a certain level of finger strength is necessary from bass players to fret notes accurately. With regular practice, mastering the bass guitar becomes more accessible, and accuracy improves over time.

The intended use of a bass differs significantly from that of electric or acoustic guitars. Bass guitars may not be the ideal choice for those interested in playing lead lines or solos. But they are perfect for musicians who appreciate rhythm and groove.

To achieve the best sound and volume, it’s essential to use a bass amplifier. These amplifiers are specifically designed to handle the lower frequencies produced by basses, ensuring optimal performance and sound quality.

The Electro-Acoustic Guitar

This type of guitar marries the raw, echoing tones of an acoustic with the strength and flexibility of an electric. That’s essentially what an acoustic-electric guitar embodies. It’s like a mix of past and present, of classic and contemporary.

It looks just like an ordinary acoustic guitar to the casual observer. Even though it carries the usual features: a hollow body, metallic strings, and the typical shape we all know.

However, a keener eye will spot the pickup, tucked away within the guitar’s body. Or sometimes under the bridge, also known as a piezo pickup. This device has one job, to turn the string vibrations into electric signals.

Even with all these added bells and whistles It delivers the same rich, earthy tones exclusive to acoustic guitars. From tender fingerpicked melodies to heartfelt strummed chords, it handles it all.

In a nutshell, an electro-acoustic guitar hands you the winning combination! The charm of acoustic and the power of electric.

The 12-String Guitar

Picture a guitar that amplifies everything you already adore about it. Now double the strings, depth, and the vibrancy. That’s the magic of a twelve-string guitar.

At first sight, a twelve-string guitar can appear a bit daunting. Navigating six strings can already be challenging, and this guitar doubles that. However, don’t let the extra strings concern you.

They’re simply twinned with the initial six, and each duo can be tuned to either the same pitch or an octave apart.

When you strike a twelve-string guitar, the twinned strings resonate together, producing a choir-like effect. It’s a sound that is robust and complete, almost echoing two guitars playing simultaneously.

This tonal characteristic has made the twelve-string a favorite among artists seeking to infuse more depth and texture into their musical expressions.

But the appeal isn’t just the sound. The act of playing a twelve-string guitar is an experience unlike any other. It calls for a tad more finger strength, pressure, and accuracy, but the outcome is undoubtedly worth the effort.

Archtop Guitar

These types of guitar are popular among jazz musicians and have a curved top. This enhances their projection and tone. They often have f-holes on their soundboard, similar to violins.

The archtop guitar is another type of semi-acoustic or hollow body. This design features a wider body because the guitar has an arched top. It sticks out further as a result.

Some versions have both an arched top and back. This makes them exceptionally wide and has a broad, deep sound. The f-holes in the body project the sound, adding to the resonance. These guitars are also popular for modern jazz and rockabilly.

Resonator Guitar

Resonator guitars are acoustics that feature a metal cone to amplify the vibrations from the strings through the bridge. While these types of guitar have sound holes, they don’t primarily contribute to the volume as they do in standard acoustics.

Instead, it’s the metal cone that gives them their loud and resonant sound. Making them well-suited to compete with the volume of brass instruments.

Initially designed for big band jazz ensembles, resonator, or dobro guitars have since found their place in a variety of musical genres. These include blues, folk, and bluegrass.

As well as certain country bands that desire a specific sound. Their versatility and qualities have made resonator guitars a popular choice for musicians seeking a powerful instrument.

Lap Steel Guitar

A steel guitar is alluring. Its construction demands precision and an artisan’s touch. With its metal strings stretched over a steel body, it emits a resonant sound that can’t be mimicked.

It can be played on your lap, with the strings facing up, plucked or strummed with a pick. And the pitch altered by sliding a steel bar, or slide, along the strings. That’s the idea of a lap steel guitar.

A Hawaiian pedal steel guitar is a complex instrument, having legs, knee levers, and foot pedals that alter the pitch of certain strings. These additions add a layer of complexity that opens up new sound possibilities.

Playing a pedal steel guitar requires a certain level of finesse, as you’re coordinating both hands, both feet, and even your knees!

From the soft hum of country music to the lively beats of honky-tonk, the steel guitar is a mainstay. Its resonant sound adds a layer of warmth and richness to these genres.

Its presence is not just confined to country music. The steel guitar also finds a home in the raw, emotive chords of blues music. Its rich, resonant tones complement the soulful strains of the blues, adding depth and dimension to the music.

Unusual Types of Guitar

In the big world of guitars, you’ve got some that don’t quite fit the mold, they dare to be different. They’re the intriguing oddballs in the guitar family.

From instruments with several necks, and even harp guitars, these variants stretch the imagination about what they can really be.

Multi Neck

Picture a guitar with multiple necks. This is exactly as it sounds! They have more than a single neck attached to the body.

Each neck has its own multiscale setup, letting the player flip between various sounds and tunings without missing a beat. It’s like packing a few guitars into one! The ultimate multi-tool in the realm of guitars.

Touch Guitars

Instead of plucking or strumming the strings, you tap them to produce a sound that is both rhythmic and melodious. It calls for a completely new set of guitar playing skills.

Harp Guitars

Sporting extra bass strings, they seem to be a blend of a guitar and a harp. They can make a variety of sounds, from the deep vibrations of a bass to the sharp, bright notes of a guitar.

These quirky guitars speak to the unending creativity in the realm of music. They question our assumptions, stretch our limits, and push us to view the guitar in a completely different way.

Even More Guitars!

In addition to all that I’ve mentioned, there are still several other types! These are also used in various musical genres.

These guitars have their own features and playing characteristics. It makes them suitable for different playing styles and preferences.

- Travel Guitars. Travel guitars are smaller than standard models and are designed for easy transport. They are popular among travelers and musicians who need a compact instrument to take on the go.

- Baritone. A baritone has a longer scale length and is designed to play lower notes than standard guitars. They have a deeper, yet bold tone. This type of guitar is commonly used in jazz, blues, and rock music where the low-end is appreciated.

- Piccolo Guitar: This is a miniature version of a full sized guitar with steel strings tuned up a fourth. The word piccolo is Italian for little, which is exactly what it is.

- Ukulele. The Ukulele is a 4-string Hawaiian instrument that looks like a small guitar. It has a trebly tone in comparison, but are easier to play and are quite popular.